Understanding the different Bureau of Internal Revenue Issuances is essential for taxpayers, legal professionals, and businesses to ensure proper compliance with Philippine tax laws. This guide outlines the official definitions and purposes of each issuance as recognized by the Bureau of Internal Revenue.

Types of Bureau of Internal Revenue Issuances

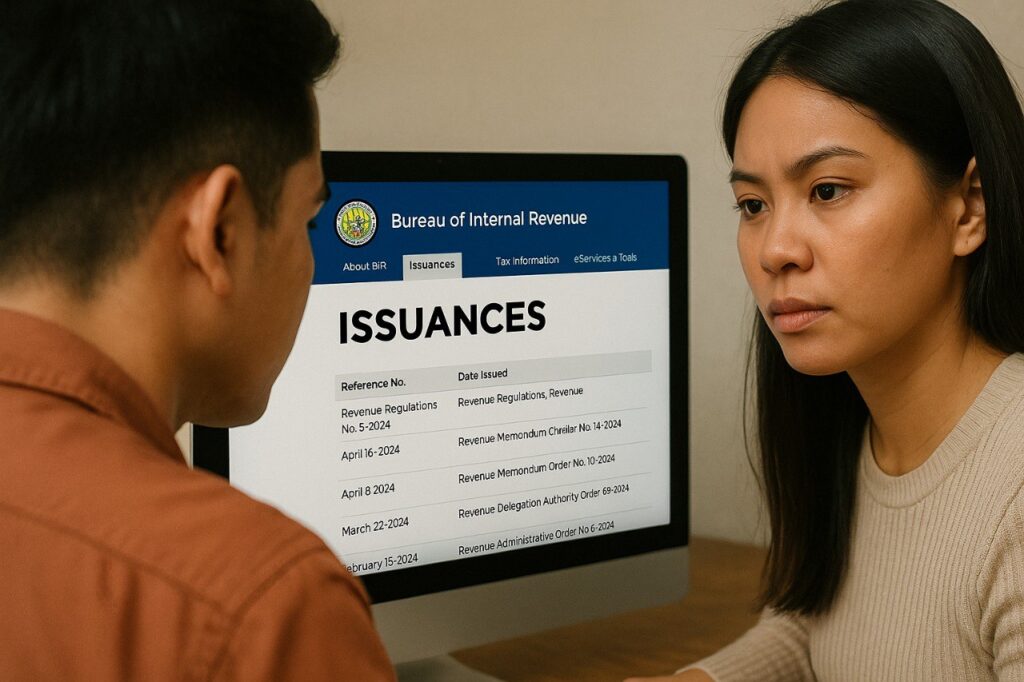

Revenue Regulations (RRs) are issuances signed by the Secretary of Finance, upon recommendation of the Commissioner of Internal Revenue, that specify, prescribe or define rules and regulations for the effective enforcement of the provisions of the National Internal Revenue Code (NIRC) and related statutes.

Revenue Memorandum Orders (RMOs) are issuances that provide directives or instructions; prescribe guidelines; and outline processes, operations, activities, workflows, methods and procedures necessary in the implementation of stated policies, goals, objectives, plans and programs of the Bureau in all areas of operations, except auditing.

Revenue Memorandum Circulars (RMCs) are issuances that publish pertinent and applicable portions, as well as amplifications, of laws, rules, regulations and precedents issued by the BIR and other agencies/offices.

Revenue Administrative Orders (RAOs) are issuances that cover subject matters dealing strictly with the permanent administrative set-up of the Bureau, more specifically, the organizational structure, statements of functions and/or responsibilities of BIR offices, definitions and delegations of authority, staffing and personnel requirements and standards of performance.

Revenue Delegation of Authority Orders (RDAOs) refer to functions delegated by the Commissioner to revenue officials in accordance with law.